Synopsis

Considering the pace at which human lives are transcending obstacles and challenges, there needs to be robust backing for their tangible and intangible assets. The insurance sector recently saw an increase in demand for the same reason from individuals and businesses alike.

The numerous ifs and buts, and why not hold customers back from signing up for insurance policies. Having customized plans according to customer preferences could help drive more customer attention to insurance businesses.

Problem

An insurance MLM software business found it difficult to effectively acquire and retain clients. Primary analysis revealed that shortcomings in customizing policies and managing them efficiently were the major concerns that made clients step back from enrolling with the business.

A defective policy management framework led to a decline in the number of clients enrolling for insurance policies

Solution

For every business, there must be an order of processes to streamline it. In the case of insurance businesses, efficiently managing policies, customizing them according to client requirements, etc are the most crucial factors that require an extra push to help the business move strong despite other challenges that the market poses daily.

Customization of complex policies

When businesses customize all aspects of their offerings to cater to customer choices, insurance businesses should design customizable policies to fit into their client preferences. The platform for insurance businesses should also be efficient in customizing insurance plans and coverages that can cater to unique customer preferences and needs. Agents should also be capable of tailoring insurance plans based on various components like insurance coverage options, premium rates, deductible amounts, additional riders, etc.,

The inability of an insurance business to tweak policies incorporating additions or deletions of specific clauses could lead to losing clients and failing this business ultimately. Dynamic customization is an intelligent way through which businesses can cater to customer preferences, whether it's small or big. For error-free policy customization, having a user-friendly interface with drag-and-drop features could help enhance the business to new levels.

Intelligent CRM capabilities

For an insurance business, an individual's clientele with the company starts from the inquiry stage passing through the pre-trial phase, and customization until the policy is finalized. At the later stage, there will be recurring renewals and claim requests from clients on and off based on their requirements. During the process, a customer needs to be communicated with, engaged, and managed efficiently to improve client satisfaction and loyalty. To manage all these elements, an insurance business cannot do without an intelligent CRM or Customer Relationship Management system that can manage contacts, and members, conduct follow-ups, take care of conversions, and send out reminders and notifications all from a single, efficient, automated, cost-effective and result-oriented platform.

CRM helped analyze customer data and interaction, provide insights on customer behavior, choices, preferences and key events in life letting agents devise strategies to offer targeted recommendations and assistance as and when required.

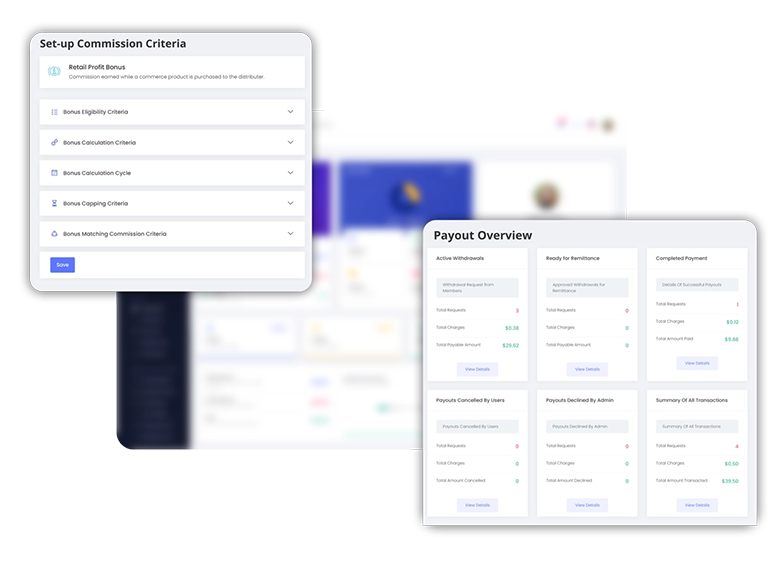

Efficient policy management

Policy management is one of the tedious tasks that agents toil with day in and out. Integrating policy management tools into the MLM insurance business helped agents comprehensively on numerous tasks from issuing policies, lessened turnaround time, tracking statuses, managing customer accounts from a centralized infrastructure, diminishing admin overhead and thus improving operational efficiency.

Competent claims management

One of the fundamental aspects of the insurance business, claims management requires meticulous processes to handle and resolve insurance claims made by policy holders. From the primary step of filing the claims to the approved final settlement or denial, managing claims is a critical process.

When clients failed to get prompt responses to their claims, it hampered the credibility of the business thus leading to a steep decline in revenue. Integrating the claims management feature helped the business ensure that the clients received the compensation that they were entitled to, without having to face any losses or damage. This further enhanced the brand integrity and upheld trust among clients and stakeholders.

Automated lead management

With numerous options to choose from, clients expect businesses to reply promptly to their queries and concerns, especially before policy finalization. Generating or capturing leads from diverse sources was yet another part that held the business behind. With automated lead management, the MLM insurance business could automate lead generation and overall management processes. This, in turn, allowed agents to capture leads through inquiries from various sources like websites, social media, referrals, etc., Automated lead scoring and enhancing workflow could ideally help agents prioritize their leads based on chances of conversion. This can help agents set their focus, time, and efforts towards the most promising prospects.

Challenges faced

While all these integrations were made to refurbish the business and help enhance its growth, the primary challenge was to stay abreast of legal and regulatory affairs which are on the higher side for insurance businesses. Staying abreast of industry standards and compliance and regulatory requirements was one major task we gave most of our attention to. For this, we assured to implement built-in compliance checks, structured management of documentation, and audit trials. This helped agents to adhere to legal and regulatory guidelines and the business to minimize their risk of non-compliance and penalties.

Expected Results

Increase in sales

44%

Increase in customer satisfaction

28%

Increased lead generation

49%

Higher customer acquisition and retention

11%

Lesser risk of legal penalties

56%

Improved agent performance

27%

Faster claims settlement

37%

Increase in sales

44%

Increase in customer satisfaction

28%

Increased lead generation

49%

Higher customer acquisition and retention

11%

Lesser risk of legal penalties

56%

Improved agent performance

27%

Faster claims settlement

37%

Devise efficient business strategies to reinvent the capabilities of your MLM business

Free Demo