COVID-19 gripped the world economy tight and ripped it off. The pandemic took center stage and the whole world looked up in awe wondering how to overcome the predicament. It made a tremendous impact on businesses and people alike. It toppled the world economies and there is not even one that escaped the impact. International Monetary Fund (IMF) estimates that the world economy faced a deflation of 4.4% in 2020.

This deflation is reflected across industries across the globe. However, the World Federation of Direct Selling Associations (WFDSA) report indicates that the industry received no major setbacks caused by the pandemic. The global retail sales in the direct selling industry increased by 2.3% year-on-year, from $175.3 billion in 2019 to $179.3 billion in 2020.

So, we set out to measure this impact, good or bad, on the direct selling industry and the direct selling brands in particular.

Research methodology

We selected 10 out of the top 100 direct selling brands and analyzed their search volume for a period of two years prior to the pandemic and through it, to measure the impact. We have applied data from Google Keyword Planner to analyze the search volume of these top direct selling brands with the brand name as the search term.

The research falls across two major time periods. The pre-COVID period stated here is from January 2018 to November 2019 and the COVID period spans from January 2020 to November 2021.

Research highlights

The research observed that while some of the companies marked a tremendous growth in search volume during the pandemic many others staggered to sustain.

Direct selling companies in the health and wellness sector experienced a shoot in their sales during the COVID period, with people growing more and more concerned about their health and safety.

The companies with a higher search volume have an increased growth rate in terms of revenue.

The research covers a comparison of the search popularity and annual growth rate of the companies.

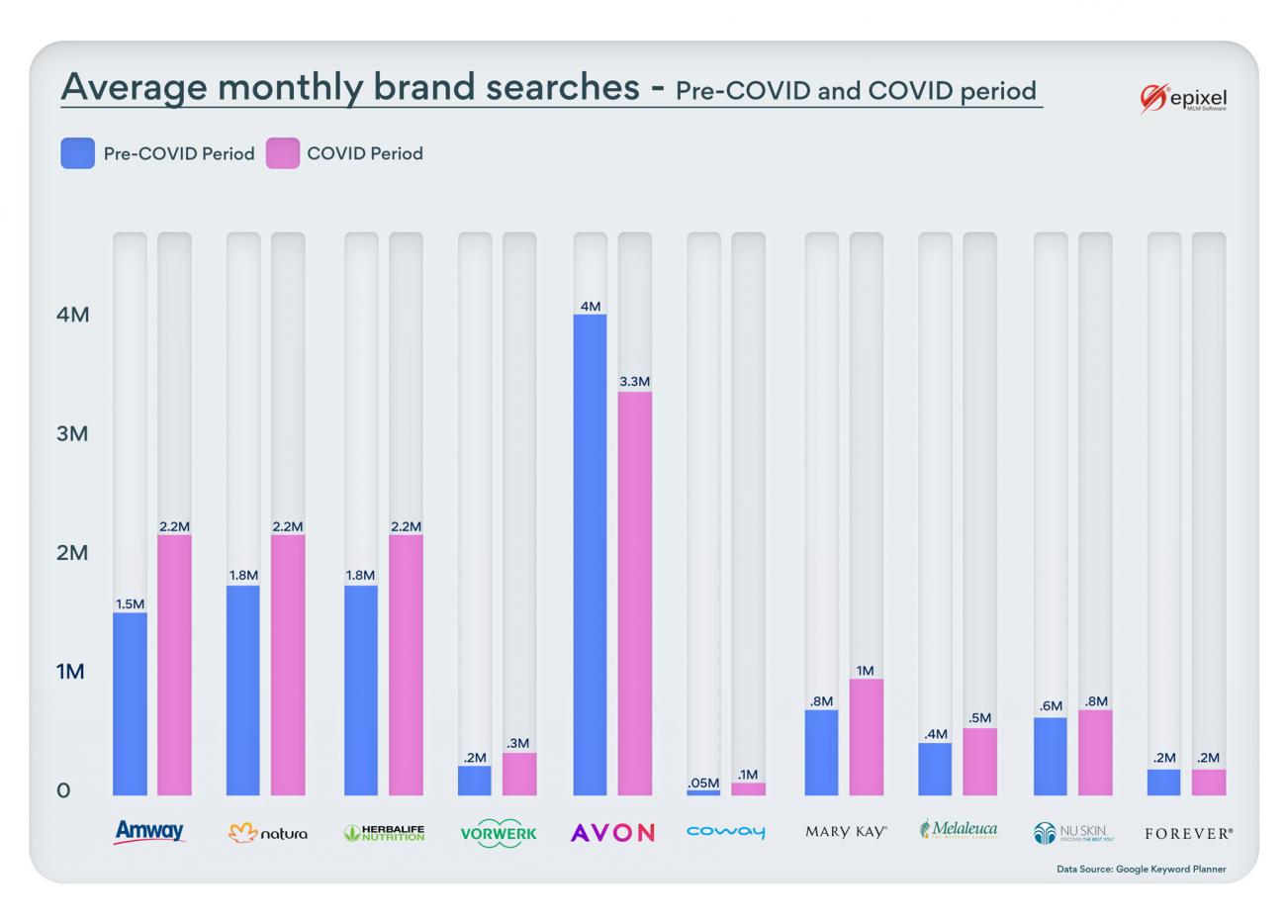

Average monthly searches of top direct selling brands

We analyzed the organic searches of popular direct selling brands and it revealed that most of the brands have seen an increase in searches except for Avon, whose search volume dropped by 0.74 million. For brands like Forever Living the search volume remained constant.

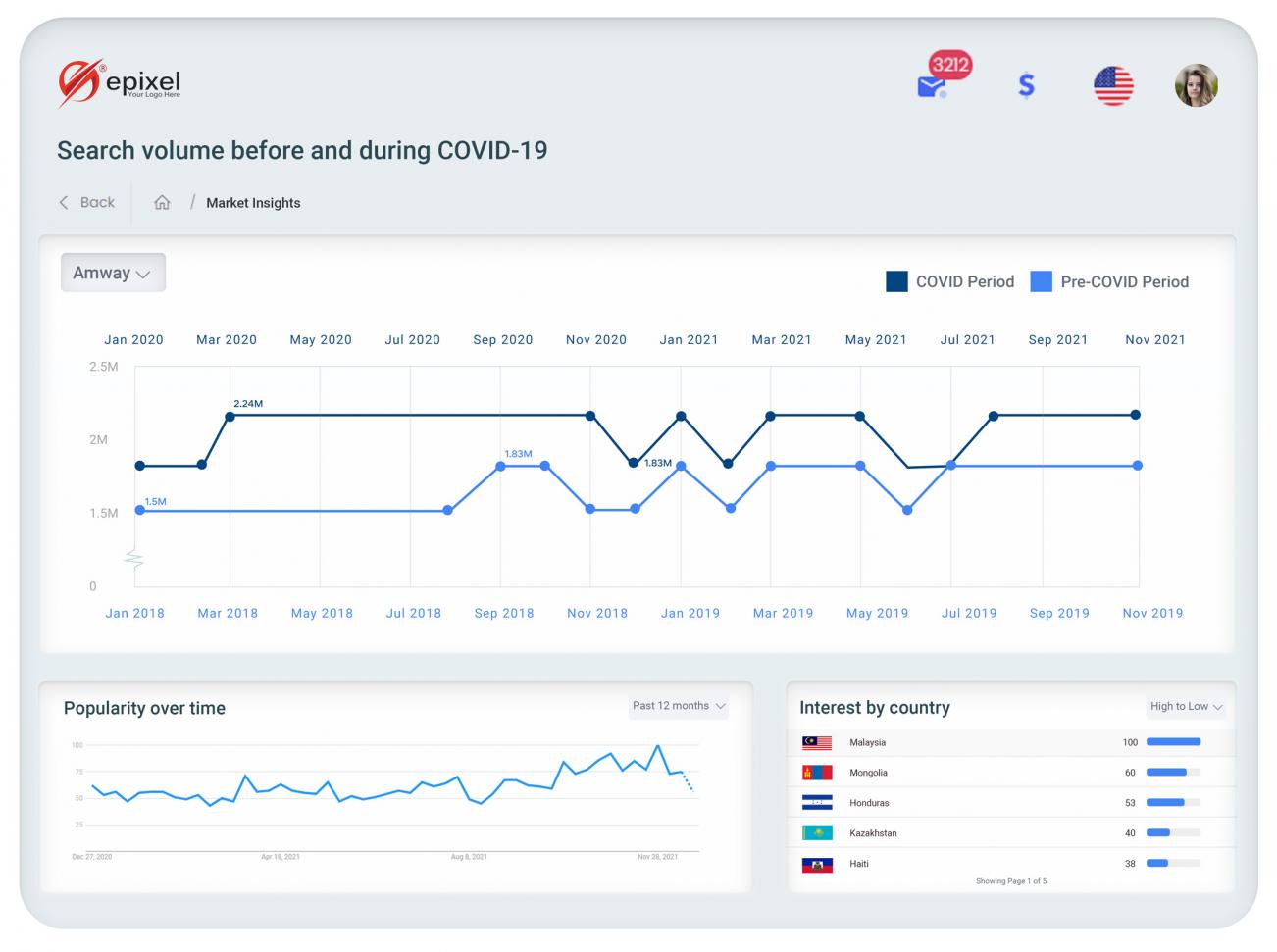

Amway

The annual retail sales of Amway increased from $8.4 billion in 2019 to $8.5 billion in 2020. This slight increase in the net revenue is also reflected in the search volume of the brand with 1.5 million searches prior to COVID and 2.24 million through the pandemic period. In either case, there was no major setback in growth for Amway.

The brand’s search volume saw an intersection at 1.83 million in July 2019 and July 2021.

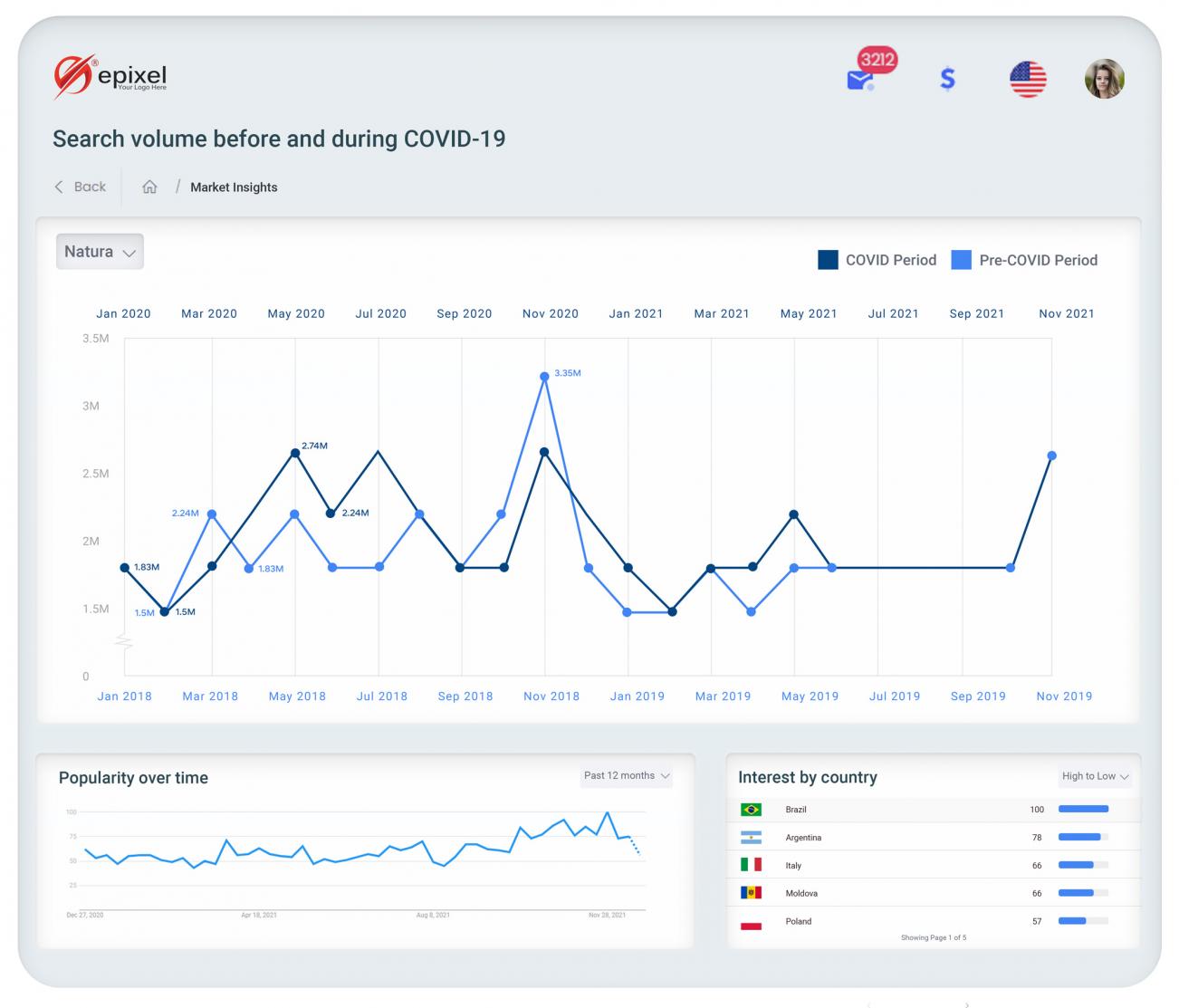

Natura

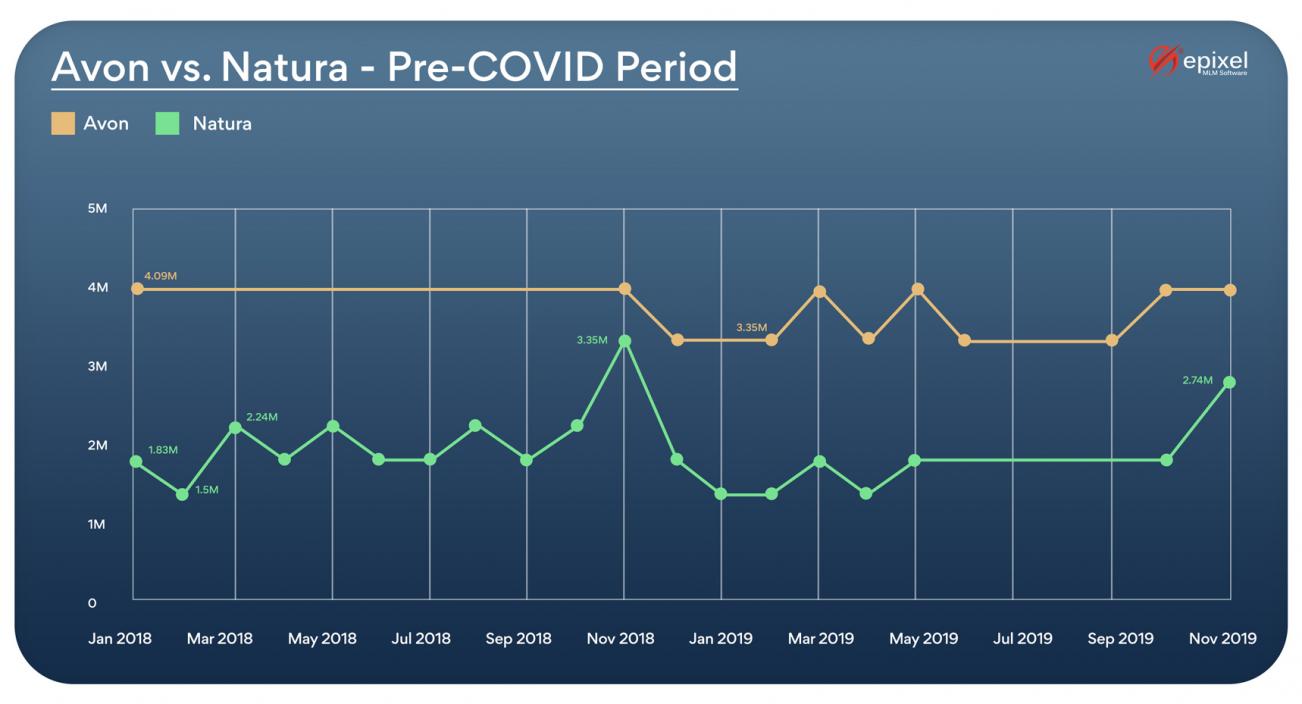

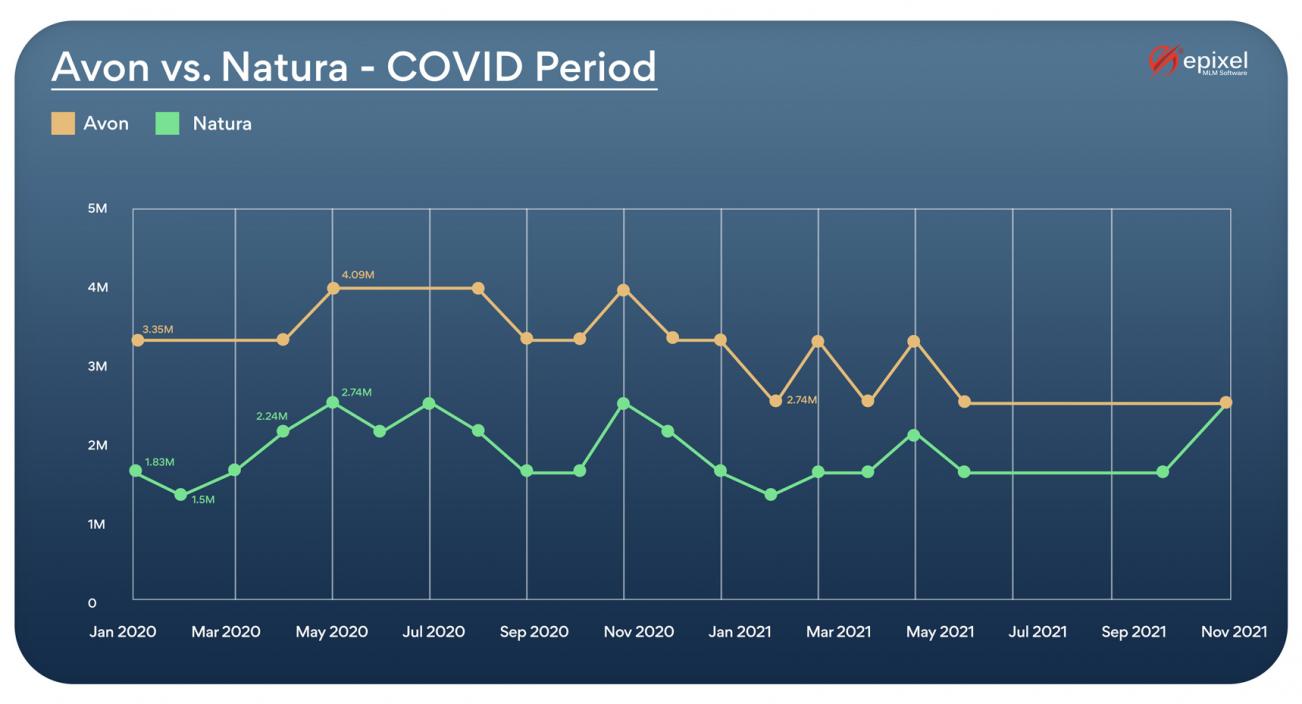

The search volume of Natura saw an increase of 22.4% compared to the pre-COVID period. The company’s growth rate surpassed its search volume by a giant 96% from 2019 marking $7.16 billion in retail sales in 2020.

However, after acquiring Avon in January 2020, Natura & Co. faced a net loss of $140 million affecting the growth of the company in the first quarter. It also received a severe drop in search popularity from across the world during the same period when compared to the rest of the year.

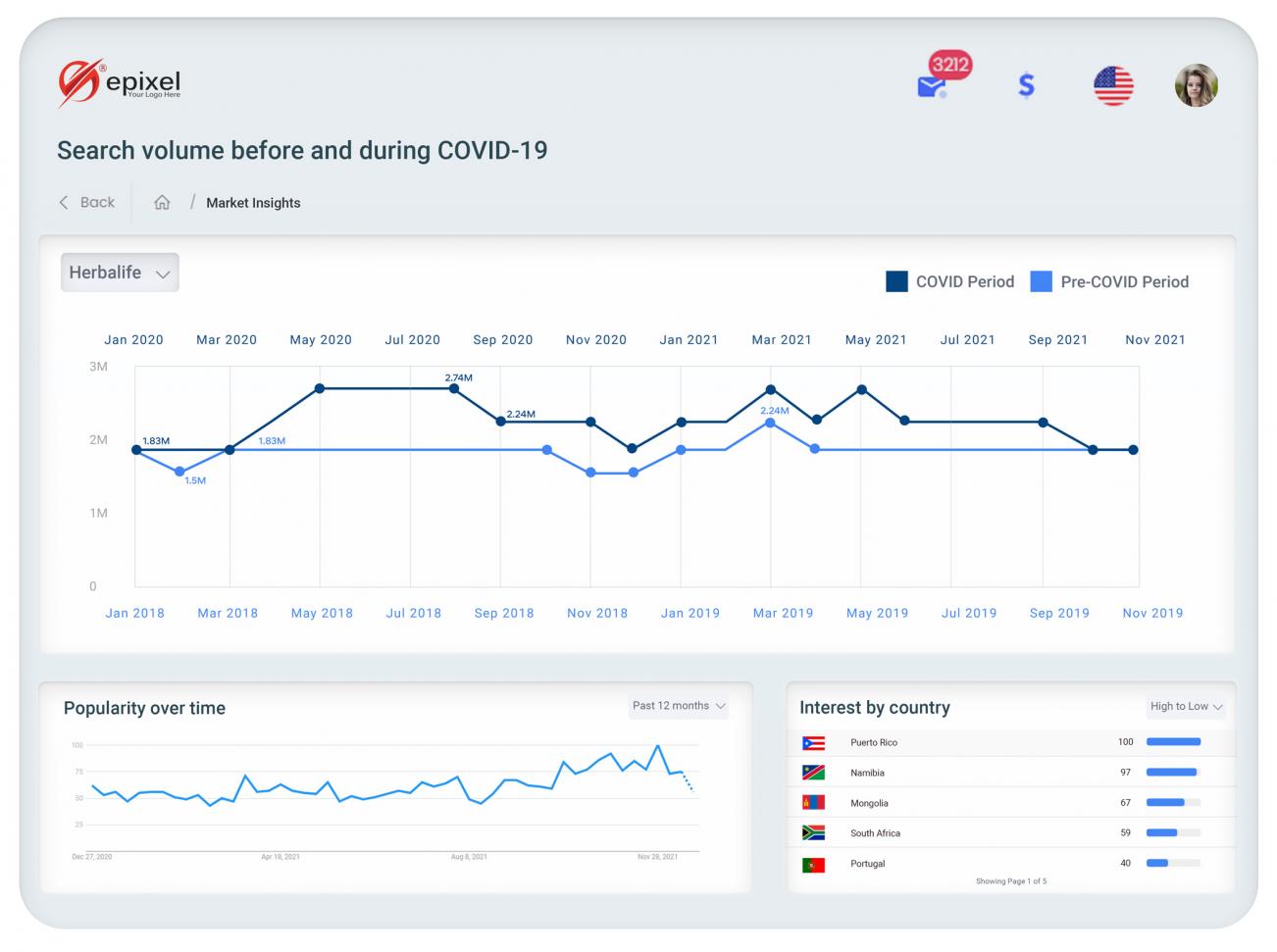

Herbalife

In line with Amway and Natura, Herbalife maintained a record average monthly search of 2.24 million, a difference of 0.41 million from the pre-COVID period.

The company had reported record-breaking sales with a 14% increase from $4.87 billion in 2019 to $5.54 billion in 2020.

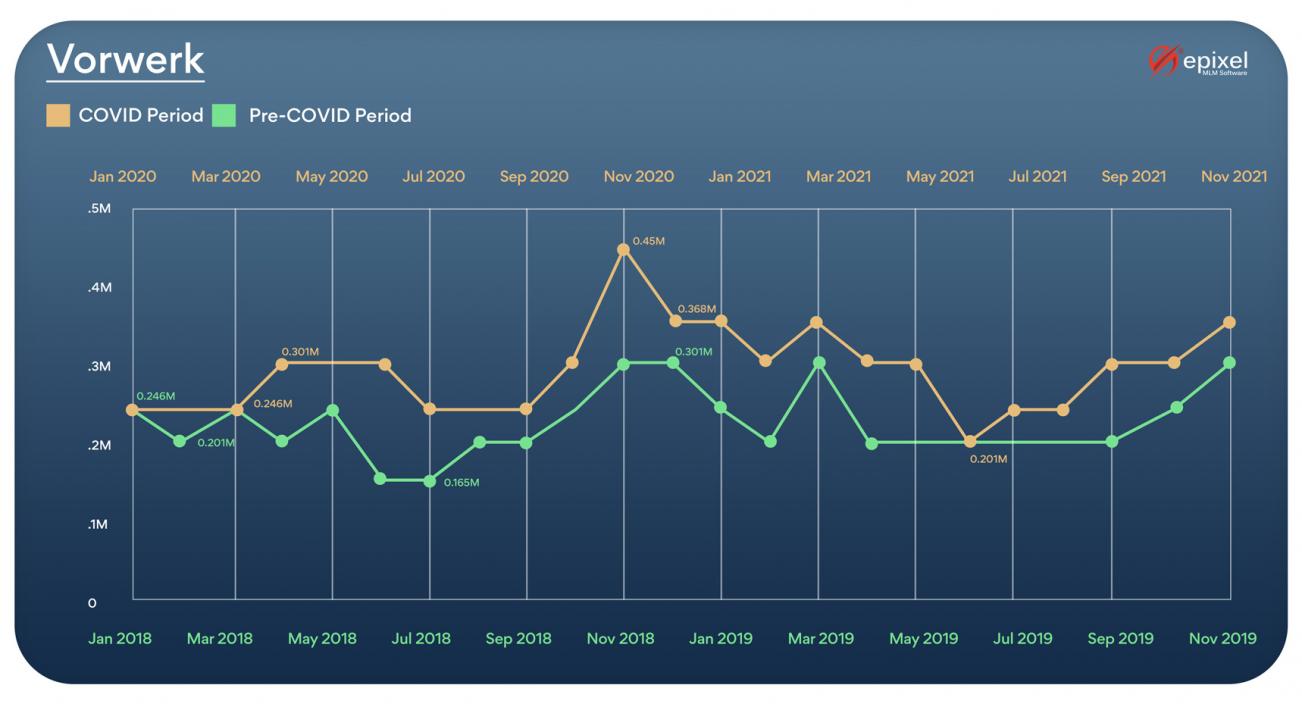

Vorwerk

The search volume of Vorwerk has also seen an increase of 0.06 million average monthly searches with respect to its search volume in the pre-COVID period. This slight increase is also reflected in the company’s annual retail sales revenue of $4.4 billion. The company’s growth rate marked a 4% increase from the previous year’s $4.23 billion.

Avon

In the case of MLM Avon, average monthly search volume fell sharply marking a negative difference of 0.74 million. The major change that the brand underwent was its acquisition by Natura & Co. in January 2020. We are not sure if that was the reason for the decline in search volume but the company’s revenue also faced a major slash down, a 2.4% decrease in Q1, 2020.

Discover new opportunities to enter new markets

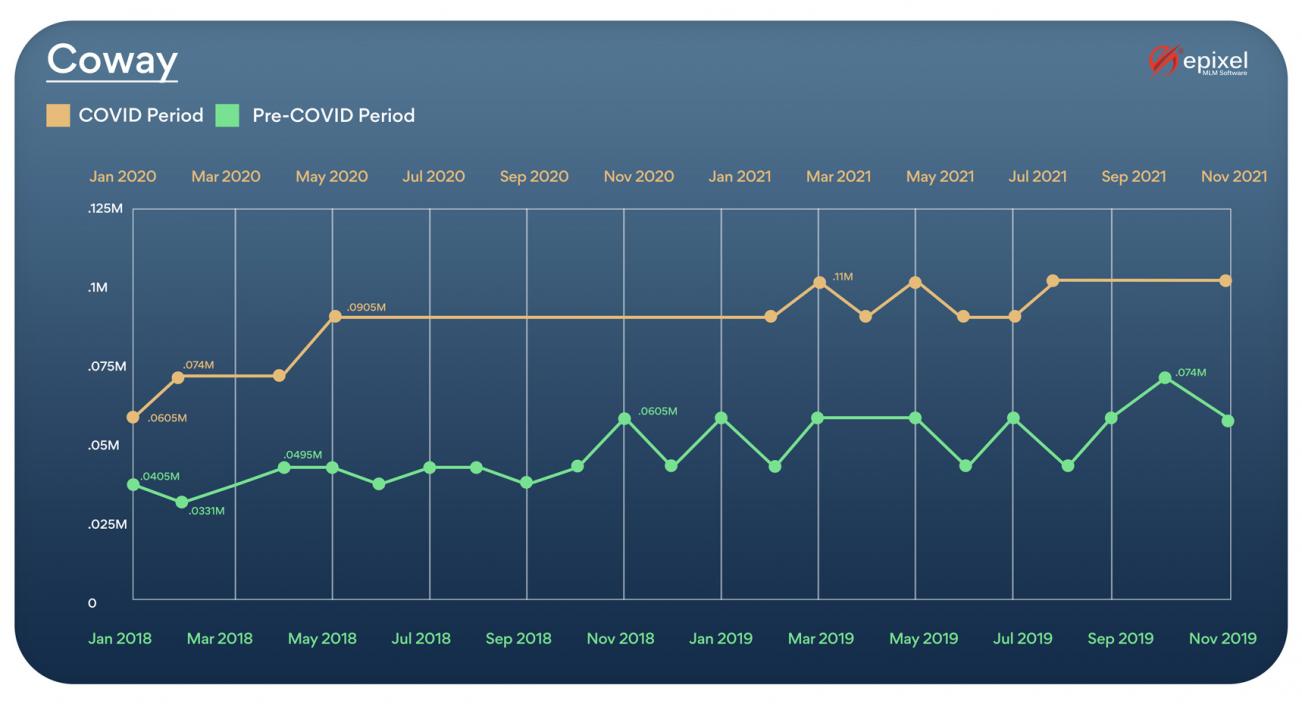

Coway

Coway’s average monthly searches marked 0.05 million in the pre-COVID period and during the pandemic period, the value nearly doubled to hit 0.09 million showing that the company was not majorly affected by the pandemic.

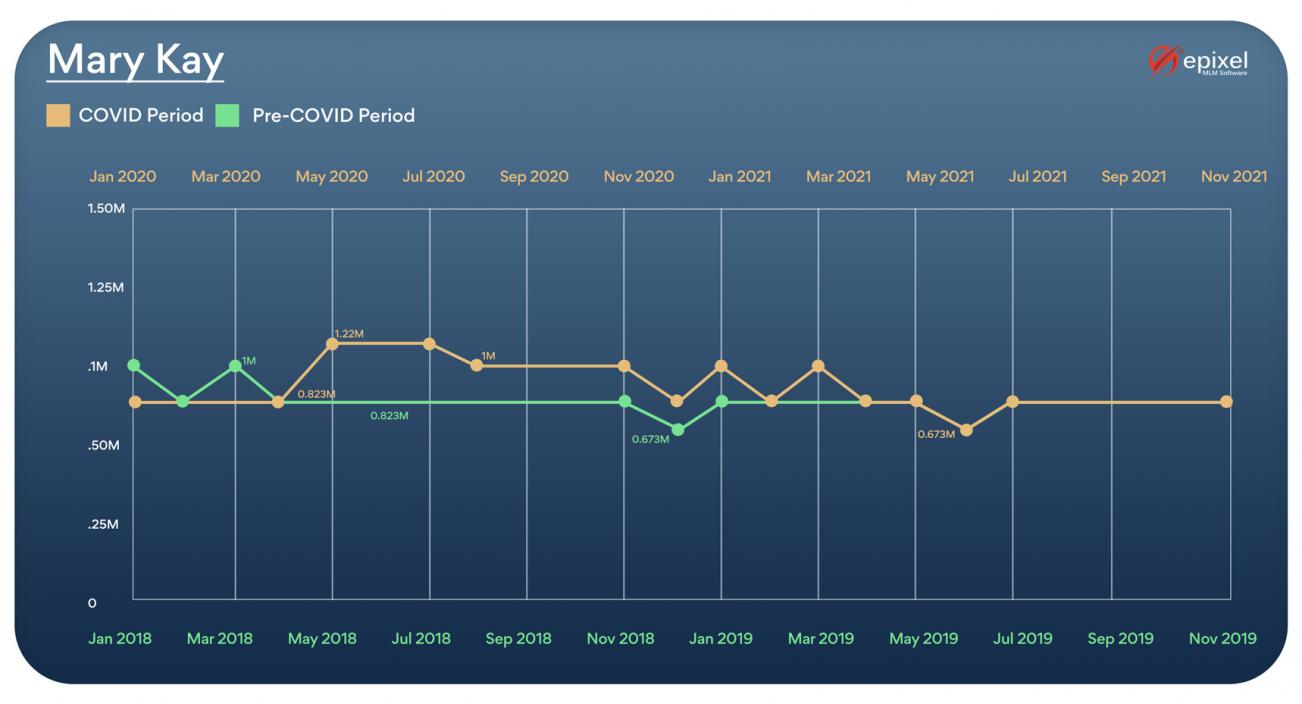

Mary Kay

The beauty brand crossed one million mark in its average monthly searches through the pandemic period. Moving stronger than ever Mary Kay exhibited a difference of 0.17 million when compared to its pre-COVID search volume of 0.82 million.

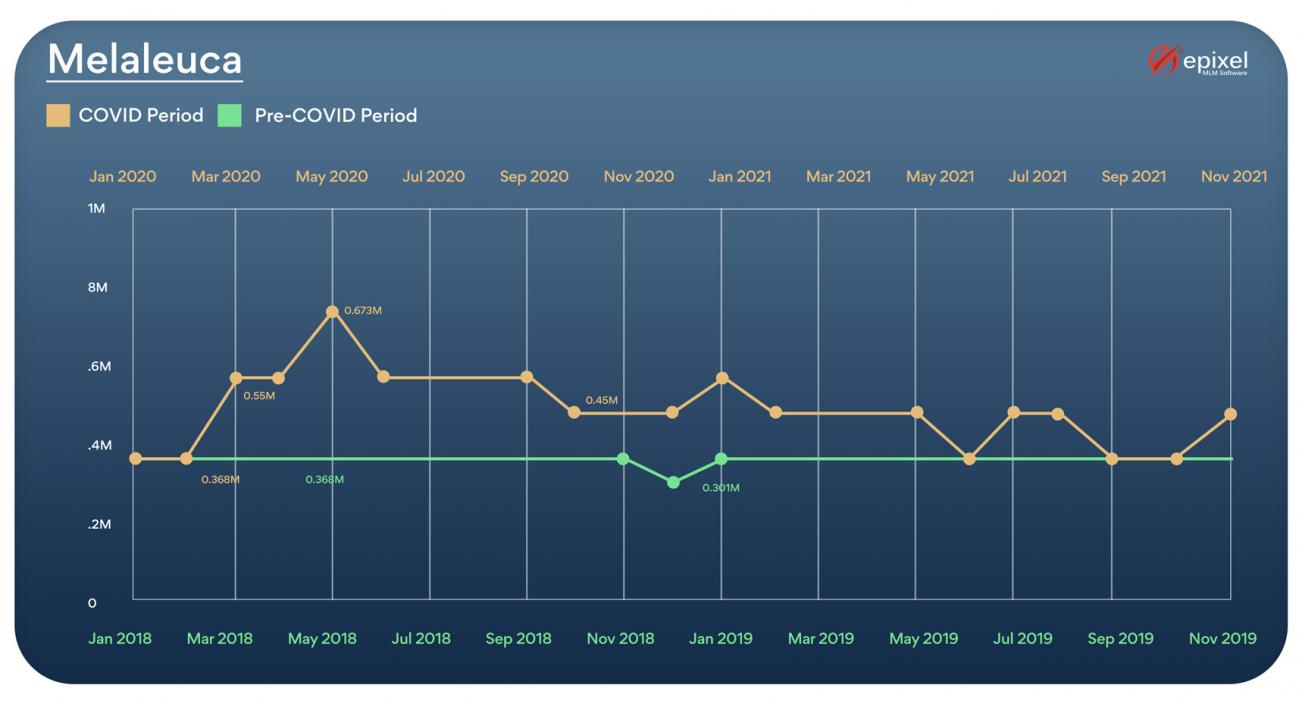

Melaleuca

The search volume of Melaleuca remained at a constant 0.36 million through the pre-COVID period. The search volume after the outbreak of COVID-19, especially in the month of May 2019 doubled arriving at a figure of 0.67 million, an all-time high for the brand until now.

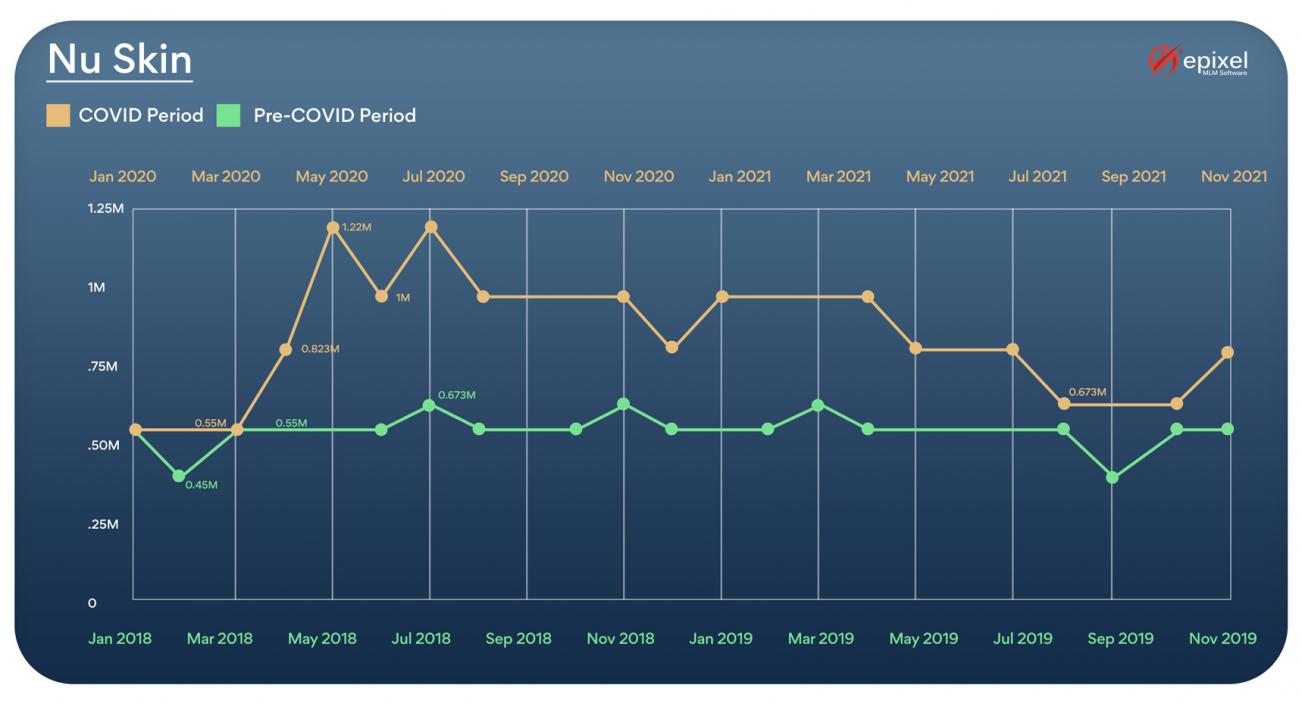

Nu Skin

Analyzing the pre-COVID search volume of Nu Skin, it is exciting to note that the brand maintained its search volume between 0.45-0.67 million. During the COVID period, the brand hit an all-time high of 1.2 million in search volume in May 2019.

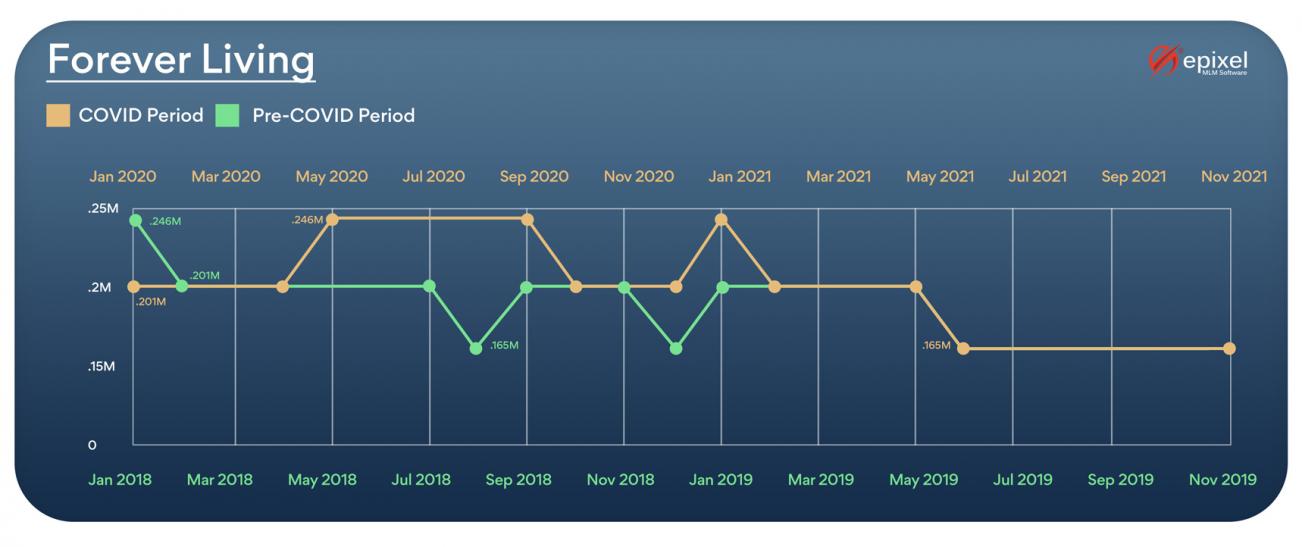

Forever Living

While all the direct selling brands under the research exhibited varying patterns in their search volumes, the search volume of Forever Living remained unaffected. The average monthly search volume stood at a constant 0.2 million before and through the pandemic period.

Change in search trends - Avon vs. Natura

Natura & Co. acquired Avon in January 2020. The acquisition had created reverberations in the search trends of both the brands. We analyzed the search trends of both the brands prior to COVID and through it and this is what we found.

Compare your market dominance across your global markets

Concluding the study,

The insights inferred throw a positive light on the growth of the direct selling brands through the pandemic. While the growth of companies in the health and wellness sector could be attributed to the changing notion of people towards living a healthy and balanced life, companies in other sectors also experienced tremendous growth despite the pandemic.

Find out from our customers how our solutions give MLM businesses an edge and exceed customer expectations

Disclaimer: The research is based on the data from Google Keyword planner with brand name as the search term. Search data may vary.

Epixel Originals: Data

& Research Studies

Leave your comment

Fill up and remark your valuable comment.